As you enter retirement, having the right insurance plans becomes crucial to ensure financial stability and peace of mind. This guide will help you understand the best insurance plans for retirees, explaining everything in simple words so everyone can understand.

Why Do Retirees Need Insurance?

Insurance is important for retirees for several reasons:

- Healthcare Costs: Medical expenses can increase with age, and insurance helps cover these costs.

- Financial Security: Insurance provides financial protection against unexpected events.

- Peace of Mind: Knowing you are covered can help you feel more secure during retirement.

- Estate Planning: Certain insurance plans can help with managing and protecting your estate.

Types of Insurance Plans for Retirees

There are different types of insurance that retirees might need. Here are the main ones:

1. Health Insurance

Health insurance is essential for retirees to cover medical expenses. Here are the key options:

Medicare

Medicare is a federal health insurance program for people aged 65 and older. It has different parts:

- Medicare Part A: Covers hospital stays, nursing care, and some home health services.

- Medicare Part B: Covers doctor visits, outpatient care, and preventive services.

- Medicare Part C (Medicare Advantage): Offers an alternative way to get Medicare benefits through private insurance companies. It often includes extra benefits like vision, dental, and prescription drugs.

- Medicare Part D: Covers prescription drugs.

Medigap (Medicare Supplement Insurance)

Medigap is supplemental insurance that helps cover costs not paid by Original Medicare, such as copayments, coinsurance, and deductibles.

Pros:

- Reduces out-of-pocket costs.

- Provides more predictable healthcare expenses.

Cons:

- Additional premium on top of Medicare costs.

- Does not cover everything (e.g., long-term care).

Medicaid

Medicaid is a state and federal program that provides health coverage for low-income individuals, including some retirees.

Pros:

- Covers many healthcare costs.

- Can work alongside Medicare for extra coverage.

Cons:

- Income and asset limits to qualify.

- Coverage varies by state.

2. Long-Term Care Insurance

Long-term care insurance helps cover the cost of services like nursing homes, assisted living, and in-home care, which are not typically covered by Medicare.

Pros:

- Provides coverage for extended care needs.

- Helps protect savings from high care costs.

Cons:

- Can be expensive.

- Premiums may increase over time.

3. Life Insurance

Life insurance provides financial support to your beneficiaries after you pass away. Here are the main types:

Term Life Insurance

Covers: Provides coverage for a specific period, like 10, 20, or 30 years.

Pros:

- Lower premiums.

- Simple and straightforward.

Cons:

- No payout if you outlive the term.

- May not be available to older retirees.

Whole Life Insurance

Covers: Provides coverage for your entire life and has a savings component called cash value.

Pros:

- Lifetime coverage.

- Builds cash value.

Cons:

- Higher premiums.

- More complex.

Guaranteed Issue Life Insurance

Covers: Provides coverage without requiring a medical exam.

Pros:

- No medical exam required.

- Guaranteed acceptance.

Cons:

- Higher premiums.

- Limited coverage amounts.

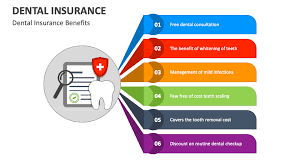

4. Dental and Vision Insurance

Medicare typically does not cover dental and vision care. Separate dental and vision insurance can help cover these costs.

Pros:

- Covers routine exams, cleanings, and glasses.

- Helps reduce out-of-pocket costs.

Cons:

- Additional premiums.

- Coverage limits and waiting periods.

5. Prescription Drug Insurance

Prescription drug insurance, often through Medicare Part D or Medicare Advantage plans, helps cover the cost of medications.

Pros:

- Reduces the cost of prescriptions.

- Covers many common medications.

Cons:

- Additional premiums.

- May have coverage gaps.

6. Annuities

Annuities are insurance products that provide a steady income stream during retirement. They can be a good way to ensure you have a regular income.

Pros:

- Provides guaranteed income.

- Helps manage longevity risk.

Cons:

- Can be complex.

- Fees and surrender charges may apply.

How to Choose the Best Insurance Plans for Retirees

Choosing the best insurance plans can be tricky. Here are some tips to help you:

1. Assess Your Needs

Think about your health, financial situation, and future goals. Consider what types of coverage you need and how much you can afford.

2. Compare Plans

Look at different insurance plans and compare their coverage options, benefits, and costs. Make sure you understand what each plan covers and excludes.

3. Check the Company’s Reputation

Choose a reliable insurance company with good customer reviews and strong financial ratings. This can help ensure your claims are handled quickly and fairly.

4. Understand the Costs

Look at the premiums, deductibles, and out-of-pocket costs for each plan. Make sure you can afford the premiums and the deductible if you need to file a claim.

5. Get Professional Advice

Consider talking to a financial advisor or insurance agent to help you choose the best plans for your needs. They can provide valuable insights and help you understand your options.

Factors That Affect Insurance Rates for Retirees

Several factors can affect how much you pay for insurance as a retiree:

1. Age

Older individuals usually pay higher premiums because they are seen as higher risk.

2. Health

Your overall health and any pre-existing conditions can significantly impact your insurance rates. Healthier individuals typically pay lower premiums.

3. Coverage Amount

The amount of coverage you choose can affect your rates. Higher coverage limits usually mean higher premiums.

4. Location

Where you live can affect your rates. Areas with higher healthcare costs or higher risks of natural disasters can be more expensive.

5. Lifestyle Choices

Lifestyle choices like smoking, heavy drinking, or not exercising can increase your insurance premiums. Maintaining a healthy lifestyle can help lower your rates.

How to Save Money on Insurance for Retirees

Here are some tips to help you save money on insurance as a retiree:

1. Shop Around

Compare quotes from different insurance companies to find the best rate. Don’t settle for the first quote you receive.

2. Choose the Right Coverage

Select a plan that covers your needs without paying for unnecessary extras. For example, if you have good dental health, you might not need extensive dental coverage.

3. Maintain a Healthy Lifestyle

Taking steps to improve your health, such as quitting smoking or losing weight, can help lower your premiums. Insurance companies often offer lower rates to healthier individuals.

4. Consider a Higher Deductible

Choosing a higher deductible can lower your premiums. Just make sure you can afford to pay the deductible if you need to file a claim.

5. Take Advantage of Discounts

Some insurance companies offer discounts for things like bundling policies, being a non-smoker, or completing a wellness program. Ask your insurance company about available discounts.

6. Use Preventive Services

Many health insurance plans cover preventive services at no additional cost. Use these services to stay healthy and catch problems early.

Common Questions About Insurance for Retirees

What is Medicare?

Medicare is a federal health insurance program for people aged 65 and older. It helps cover the cost of medical care, including hospital stays, doctor visits, and prescription drugs.

What is Medigap?

Medigap is supplemental insurance that helps cover costs not paid by Original Medicare, such as copayments, coinsurance, and deductibles.

What is Long-Term Care Insurance?

Long-term care insurance helps cover the cost of services like nursing homes, assisted living, and in-home care, which are not typically covered by Medicare.

What is a Premium?

A premium is the amount you pay for your insurance, usually monthly or yearly. It is the cost of having insurance coverage.

What is a Deductible?

A deductible is the amount you pay out of pocket before your insurance starts to help. Higher deductibles usually mean lower premiums.

What if I Can’t Afford My Premium?

If you can’t afford your premium, talk to your insurance company. They may be able to help you adjust your coverage or set up a payment plan. You can also look into government programs like Medicaid for additional assistance.

Can I Change My Plan?

Yes, you can usually change your plan during open enrollment or if you qualify for a special enrollment period. This can happen if you have a major life event, like moving or losing other health coverage.

What is an Open Enrollment Period?

An open enrollment period is a set time each year when you can sign up for or change your health insurance plan. Outside of this period, you can only make changes if you qualify for a special enrollment period.

Tips for Managing Your Insurance as a Retiree

Here are some tips to help you manage your insurance as a retiree:

Keep Records

Save copies of your policy, bills, and any communication with your insurance company. Keep track of your payments and any claims you file.

Review Your Coverage

Check your coverage regularly to make sure it still meets your needs. Consider adjusting your policy if your health or financial situation changes.

Update Your Policy

Inform your insurance company if you make any significant changes, like moving to a new location or buying a new property.

Ask Questions

If you don’t understand something about your policy, ask your insurance company or an insurance agent. Make sure you fully understand your coverage and costs.

Stay Informed

Keep up with changes in the insurance industry and adjust your coverage as needed. Stay informed about your policy and any new features or options that may become available.

Conclusion

Choosing the best insurance plans for retirees is important for protecting your health and financial security. By understanding the different types of insurance, comparing plans, and using the tips in this guide, you can find the best insurance options for your needs. Remember to assess your needs, check the company’s reputation, and understand the costs. With the right information and guidance, you can choose the best insurance plans to provide financial protection and peace of mind during your retirement.